section 179 deduction vehicle list 2024 – Below is our annual guide to Tax Code Section 179 vehicle from qualifying, so do your homework! IMPORTANT: This is the list of 2023 models that qualify, however, in 99% of the cases, the . you need to prorate the deduction. If you happened to purchase the vehicle in a prior year and want to claim the Section 179 deduction, unfortunately, that is not permissible. To qualify for the .

section 179 deduction vehicle list 2024

Source : www.joerizzamaserati.com

Section 179 Deduction List for Vehicles in 2023 | Block Advisors

Source : www.blockadvisors.com

Section 179 Eligible Vehicles at Bob Moore Auto Group

Source : www.bobmoore.com

Section 179 Deduction List for Vehicles in 2023 | Block Advisors

Source : www.blockadvisors.com

UPDATES] Section 179 Deduction Vehicle List 2023

Source : www.xoatax.com

Section 179 Deduction List for Vehicles in 2023 | Block Advisors

Source : www.blockadvisors.com

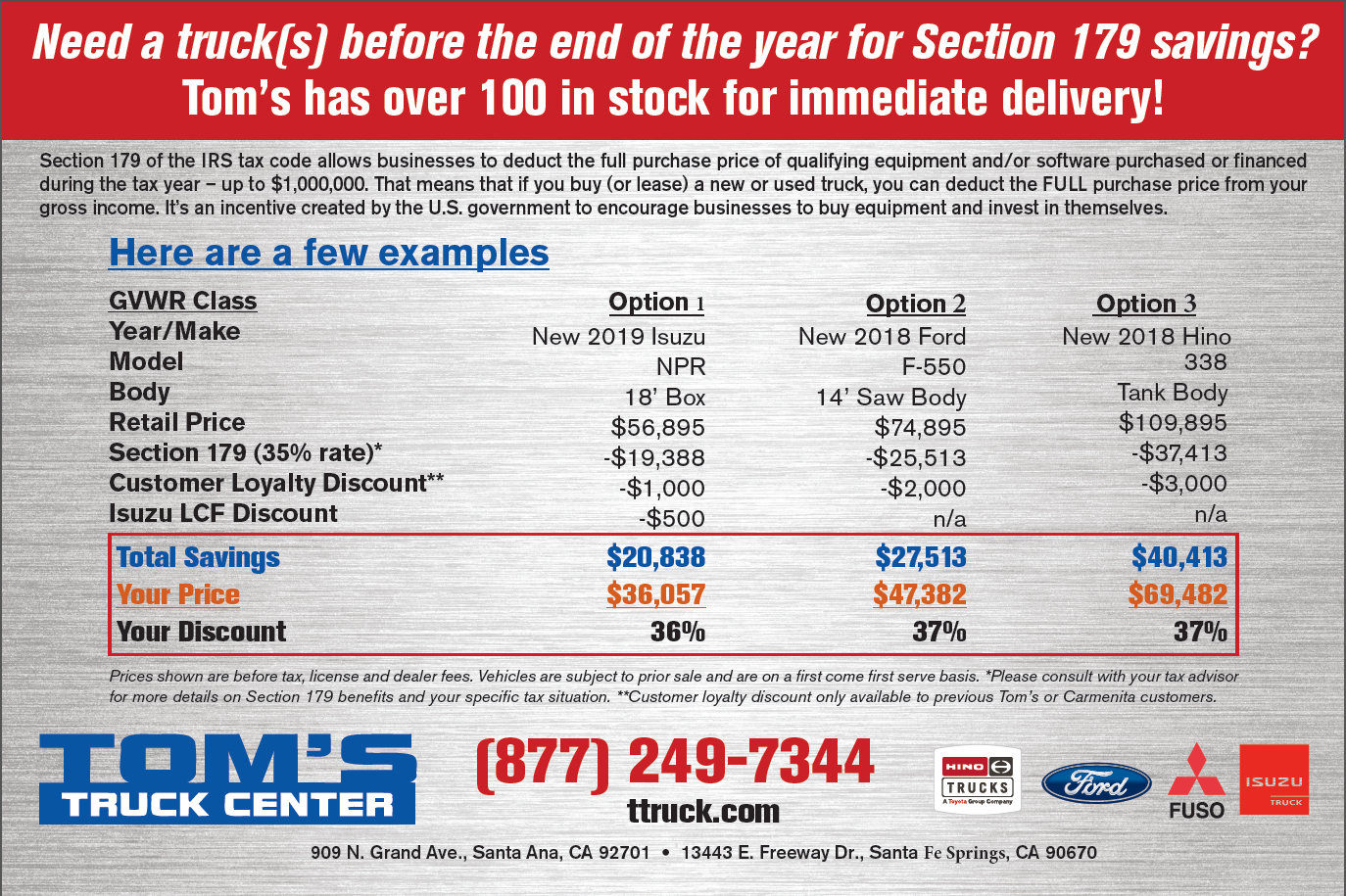

Section 179 Deductions! | Tom’s Truck Center

Source : www.ttruck.com

Section 179 Tax Deduction for 2023 | Section179Org

Source : www.section179.org

Section 179 Tax Exemption | Land Rover Anaheim Hills

Source : www.landroveranaheimhills.com

BEST Vehicle Tax Deduction 2023 (it’s not Section 179 Deduction

Source : www.youtube.com

section 179 deduction vehicle list 2024 Maserati Section 179 Deduction for Vehicles | Joe Rizza Maserati: Section 179 is one of the more misunderstood parts of the US tax code. While many companies take advantage of the tax deduction for equipment purchases, a surprising number of US businesses do not. . Section 80E of the Income Tax Act provides provisions for tax deductions on educational loans. This is available only for the interest component of the loan. This can only be claimed once the loan .